What are the steps to cancel a subscription for fiscal representation in my NIF by changing it to Portuguese address?

Instructions

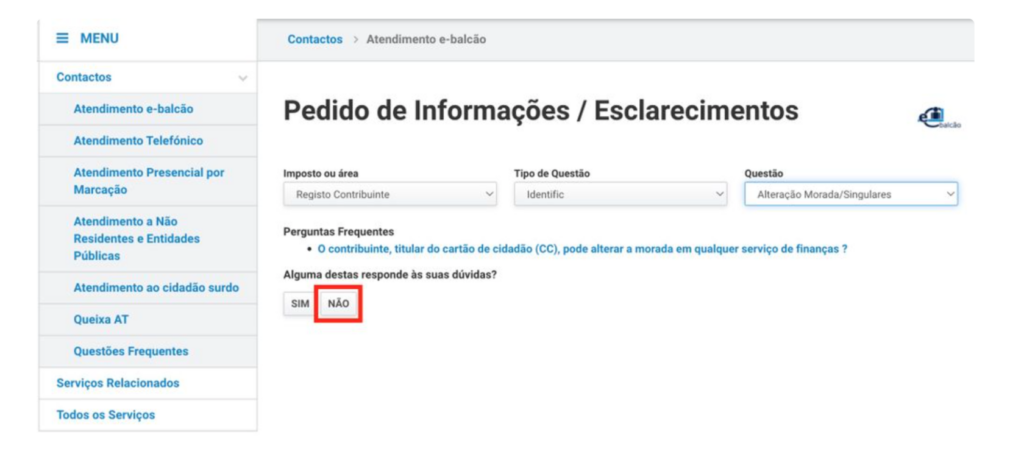

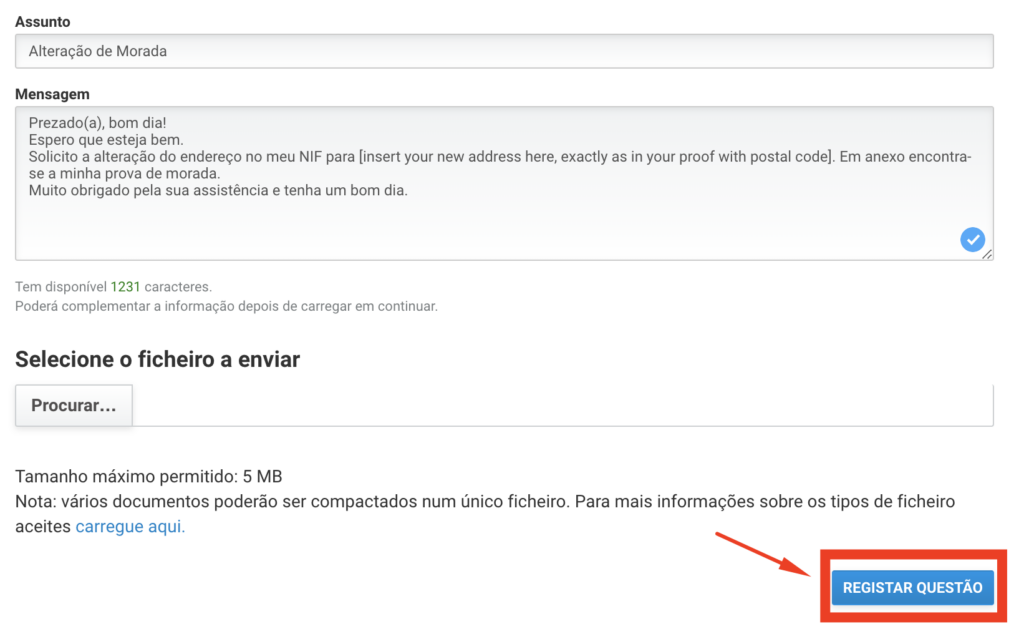

Imposto ou área = Registro Contribuinte (Tax or area = Taxpayer Registration)

Tipo de questão = Identific (Type of question = Identified)

Questão = Alteração Morada/Singular (Question = Change of Address / Singular)

*Translation: Change of Address

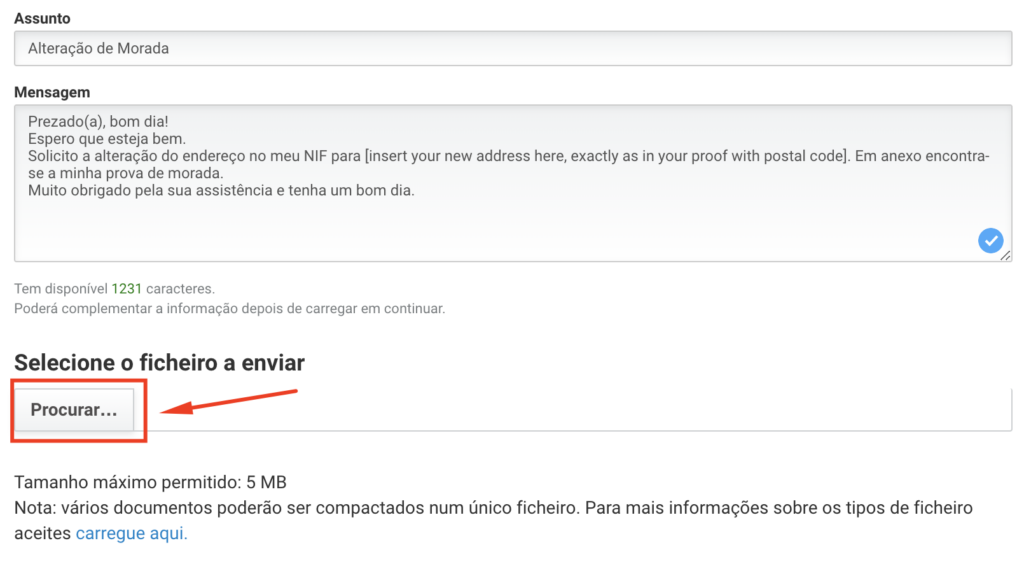

“Prezado(a), bom dia!

Espero que esteja bem.

Solicito a alteração do endereço no meu NIF para [insert your new address here, exactly as in your proof with postal code]. Em anexo encontra-se a minha prova de morada.

Muito obrigado pela sua assistência e tenha um bom dia.”

Translation:

“ Dear, good morning!

I hope you are well.

I request to change the address on my NIF to [insert your new address here, exactly as in your proof with postal code]. Attached is my proof of address.

Thank you very much for your assistance and have a nice day..”

- Proof of Address for non-EU – see acceptable documents here

- Proof of Address for UE/EEE/SUÍÇA – see acceptable documents here

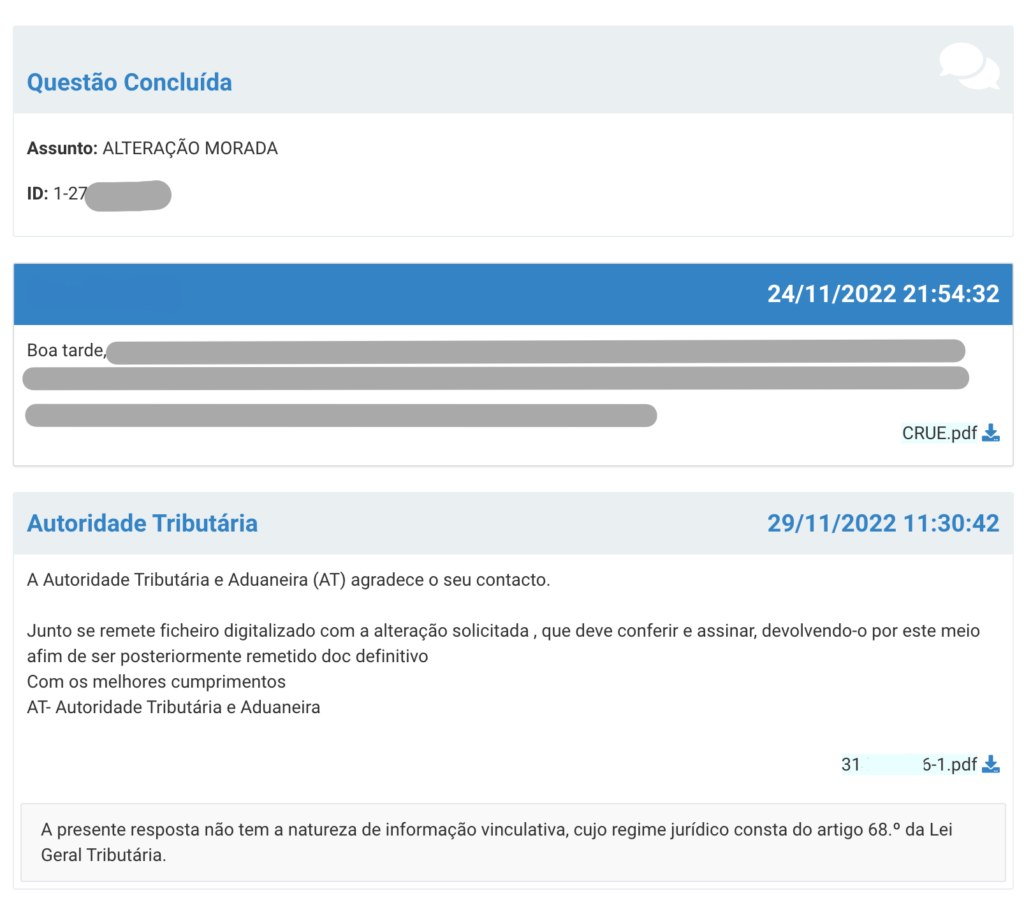

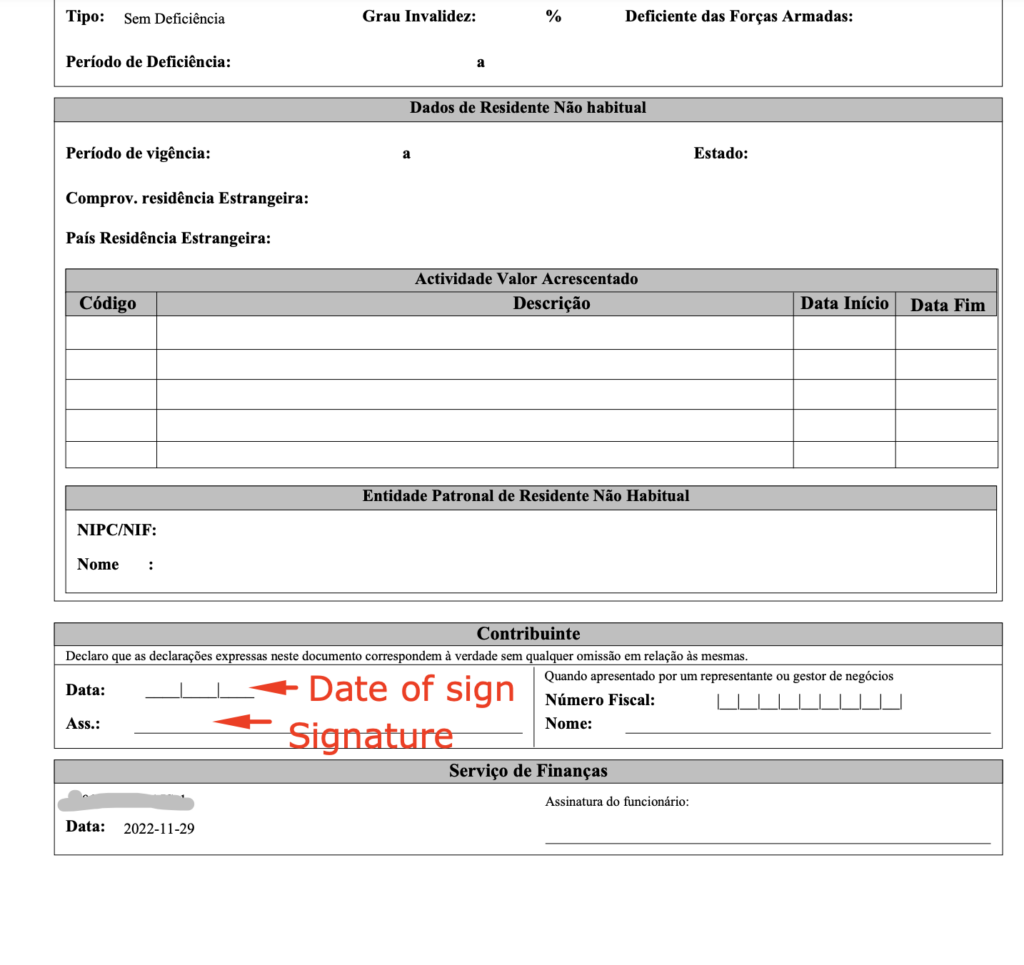

On Page 2 of the document: Add today’s date and sign (see guide below).

Send this document back to the Tax Office by responding to the message thread and attaching the signed 2-page document. This must be completed within 48 hours of receiving the Alteração document.

Include the following message: “Veja o documento assinado em anexo”

Translation: See the signed document attached

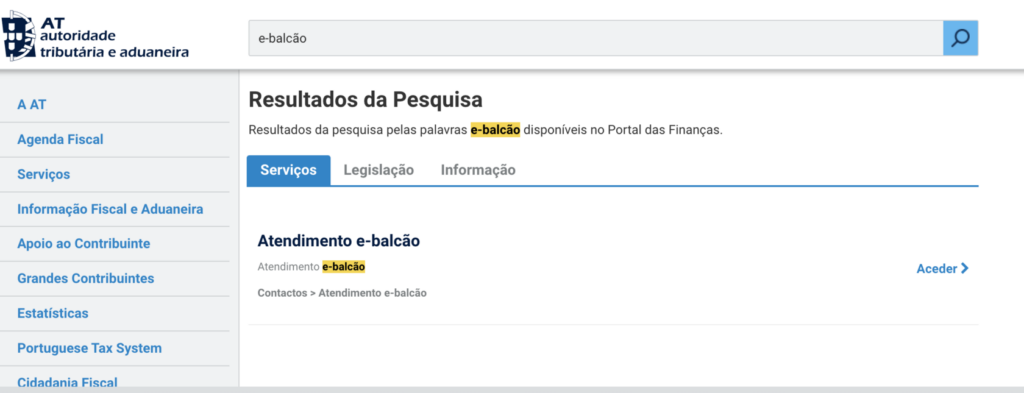

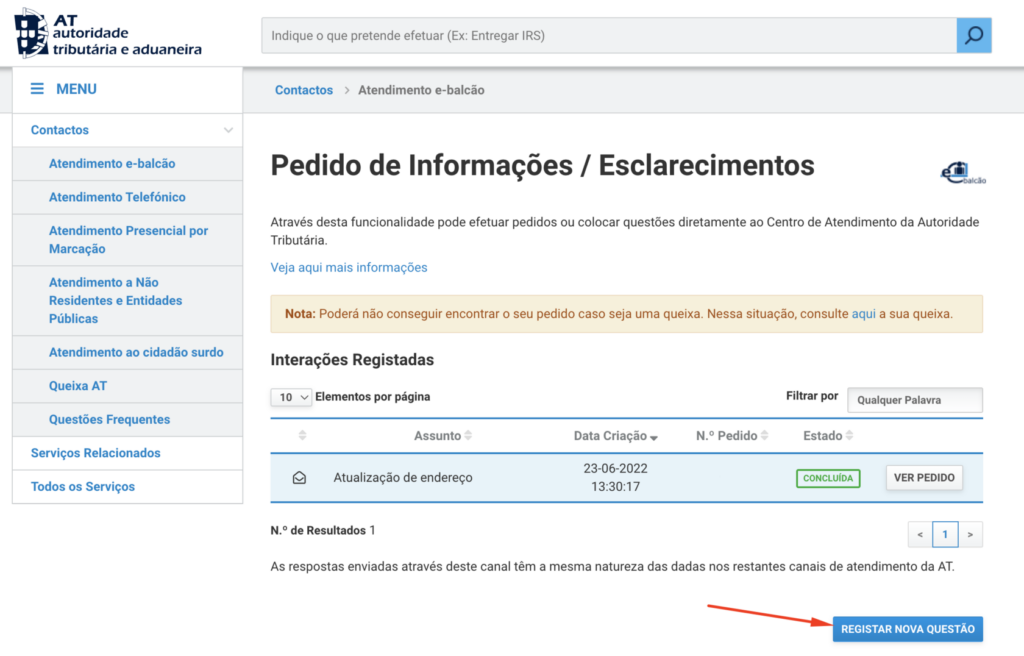

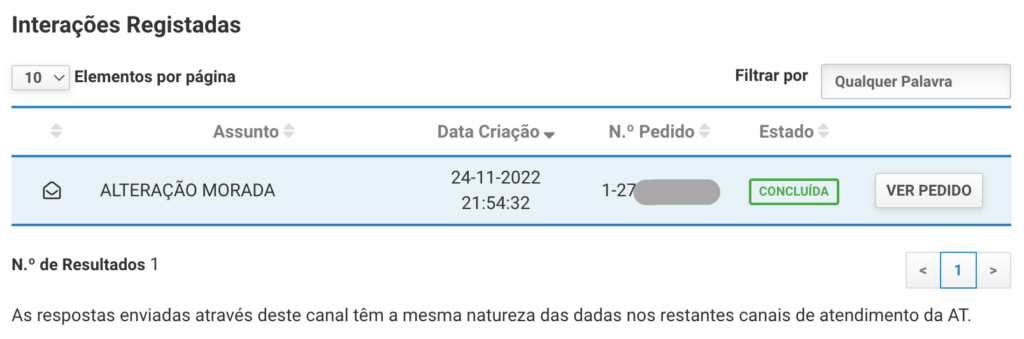

You can use this quick link to go to the Atendimento e-balcão.

11. The next page should have your new NIF document available for download.